The Telangana Aarogyasri Health Insurance card, newly named the Rajiv Aarogyasri Health Insurance card by the recently formed Congress government, is a government-funded health insurance scheme with an enhanced limit of 10 lakhs, up from the previous 5 lakhs. This scheme aims to offer cashless treatment to eligible beneficiaries in Telangana. The fundamental objective is to provide financial protection and ensure access to quality healthcare for all residents of Telangana, irrespective of their income or social status.

Health Insurance Coverage: Telangana Rajiv Aarogyasri Card Apply Online Ts

The Telangana Aarogyasri Health Insurance has undergone a transformation and is now known as the Rajiv Aarogyasri Health Insurance card 2024, courtesy of the recently formed Congress government. This alteration comes hand in hand with a substantial increase in the coverage limit, soaring from the previous 5 lakhs to an enhanced and more comprehensive 10 lakhs. This development underscores the government’s commitment to bolstering healthcare accessibility and ensuring that the residents of Telangana receive top-notch medical assistance without facing financial constraints.

The Rajiv Aarogyasri card, with its upgraded coverage, serves as a pivotal tool in the mission to provide cashless treatment to eligible beneficiaries across Telangana. The scheme’s overarching goal remains unwavering – to furnish financial protection and facilitate access to high-quality healthcare services for every resident in the region. Notably, this commitment transcends socio-economic barriers, exemplifying the government’s dedication to promoting health equity and well-being among the diverse populace of Telangana.

Benefits of the Telangana Rajiv Aarogyasri Health Insurance Card:

The Rajiv Aarogyasri Card offers a range of benefits aimed at enhancing healthcare accessibility and providing financial support to eligible beneficiaries. Some of the key benefits include:

- Cashless Treatment: One of the primary advantages of the Rajiv Aarogyasri Health Insurance Card is that it provides cashless treatment. Cardholders can receive medical services at network hospitals without the need for immediate out-of-pocket payments.

- Wide Coverage: The card covers a broad spectrum of medical treatments, including surgeries, therapies, and diagnostic tests. This ensures that beneficiaries have comprehensive coverage for various healthcare needs.

- Enhanced Coverage Limit: With an increased coverage limit, the Rajiv Aarogyasri Health Insurance now provides greater financial protection. This enhancement from the previous limit to a more substantial amount ensures that beneficiaries can address more extensive healthcare requirements.

- Quality Healthcare Access: The card facilitates access to quality healthcare services at empaneled hospitals and healthcare facilities. This ensures that beneficiaries receive medical treatment from reputable institutions.

- Family Coverage: The Rajiv Aarogyasri Health Insurance extends its coverage to the entire family, offering financial protection and healthcare benefits to all family members. This family-centric approach ensures holistic well-being.

- Coverage for Pre-existing Conditions: The Rajiv Aarogyasri scheme typically covers pre-existing health conditions, providing assistance to individuals with ongoing medical needs.

- Transparent Process: The application and approval process for the Rajiv Aarogyasri Card is designed to be transparent, ensuring that eligible individuals can navigate the system with clarity and ease.

- Socio-economic Inclusivity: The Rajiv Aarogyasri Card is designed to be inclusive, irrespective of the beneficiary’s income or social status. This ensures that healthcare benefits are accessible to a diverse range of individuals and families.

- Government’s Commitment: The Rajiv Aarogyasri Card reflects the government’s commitment to prioritizing the health and well-being of the residents of Telangana. It serves as a tangible demonstration of the government’s dedication to providing affordable and accessible healthcare.

- Reduced Financial Burden: By offering financial assistance and cashless treatment, the Aarogyasri Card helps in alleviating the financial burden associated with medical emergencies, surgeries, and other healthcare needs.

Short Scheme Details:

| Name | Telangana Rajiv Aarogyasri Health Insurance Card |

| Launched by | Government Of Telangana |

| Beneficiaries | People of Telangana |

| Benifits | Providing Free Treatment For Health Upto 10 Lakhs |

| Official website | https://www.aarogyasri.telangana.gov.in/ |

BENEFICIARY BENEFITS & SCHEME FEATURES

The Telangana Aarogyasri Health Insurance, a leading health insurance program, offers numerous benefits and distinctive features to beneficiaries. Notably, it ensures cashless treatment, allowing access to medical services without immediate financial strain. The scheme recently underwent enhancements, including a substantial increase in the coverage limit to 10 lakhs, providing broader financial protection for various medical treatments. Embracing a family-centric approach, the Aarogyasri card extends its benefits to all family members under a single insurance umbrella, fostering comprehensive healthcare for households.

As a government-funded initiative, the Aarogyasri Insurance is distinguished by its commitment to inclusivity. Covering pre-existing conditions, it demonstrates dedication to addressing ongoing health needs. The scheme’s transparent application process and access to quality healthcare at empaneled institutions further highlight its features. The recent name change to the Rajiv Aarogyasri Card signifies a government initiative to enhance the scheme’s reach, emphasizing its crucial role in ensuring accessible, affordable, and quality healthcare for the residents of Telangana.

Health Insurance Scheme Features:

- Government Funding:

- The Aarogyasri Health Insurance card is a government-funded initiative, emphasizing the commitment of the government to prioritize the health and well-being of its residents.

- Name Change – Rajiv Aarogyasri Health Insurance Card:

- The scheme underwent a name change to Rajiv Aarogyasri Health Insurance under the Congress government. This renaming is often accompanied by enhancements to coverage limits and benefits.

- Increased Coverage Limit:

- The coverage limit was increased from the previous amount to a more substantial figure, ensuring that beneficiaries have access to a higher financial ceiling for their healthcare needs.

- Socio-economic Inclusivity:

- The Aarogyasri card is designed to be inclusive, disregarding the income or social status of the beneficiaries. This ensures that healthcare benefits are accessible to a diverse range of individuals and families.

- Commitment to Health Equity:

- The scheme reflects the government’s commitment to health equity, aiming to bridge the gap in healthcare accessibility and affordability among the residents of Telangana.

In summary, the Telangana Aarogyasri card’s beneficiary benefits and scheme features collectively contribute to making quality healthcare more accessible and affordable for a broad spectrum of individuals and families in the region. The comprehensive nature of the scheme reflects the government’s dedication to promoting the health and well-being of its residents.

Diseases Covered Under Rajiv Aarogyasri Health Insurance Scheme

The Rajiv Aarogyasri Health Insurance Card scheme provides cashless treatment for a wide range of medical conditions in over 507 empanelled hospitals across the state. Here’s a summary of the major diseases covered, along with some additional details:

Major Health Insurance Categories:

- Cancer: All types, including breast, lung, colon, leukemia, and more.

- Kidney Disease: Chronic kidney disease, kidney failure, dialysis, etc.

- Heart Disease: Coronary artery disease, heart attack, heart failure, and others.

- Neurological Conditions: Stroke, Parkinson’s disease, Alzheimer’s disease, cerebral palsy, etc.

- Orthopaedic Conditions: Fractures, dislocations, joint replacements, and more.

Other Covered Diseases:

- Diabetes

- Hypertension

- Tuberculosisv

- HIV/AIDS

- Gastrointestinal disorders

- Respiratory illnesses

- Eye diseases

- Ear, nose, and throat (ENT) conditions

- Mental health disorders

Exclusions:

- Cosmetic procedures

- Dental implants (except for congenital defects or accidents)

- Organ transplants (except live donor transplants in some cases)

- Certain infectious diseases covered by national programs

More Information:

- The specific diseases and procedures covered are listed in the Telangana Aarogyasri Medical Packages Booklet, available online and at empanelled hospitals.

- The scheme covers pre-operative investigations and post-operative care for up to 15 days.

- Family members, including spouse, children under 25 (unmarried), and dependent parents, are also covered.

Eligibility criteria and required documents

To be eligible for Rajiv Aarogyasri Telangana, applicants must fulfill the following criteria:

1. The candidate must be a permanent resident of Telangana.

2. The applicant must fall within the below-the-line poverty category.

3. Candidates who possess any of the following cards are qualified for the program:

– White Card

– Health Card

Required Documents:

For Rajiv Aarogyasri Telangana, applicants need to submit the following important documents:

- Applicant’s Photo

- Aadhar Card

- BPL Card

- Ration Card

- White Card

- Mobile Number

How to Apply for the Telangana Rajiv Aarogyasri Health Insurance Card Online:

Applying for the Telangana Aarogyasri Health Insurance online is a streamlined process that ensures convenience for applicants. Follow the steps below:

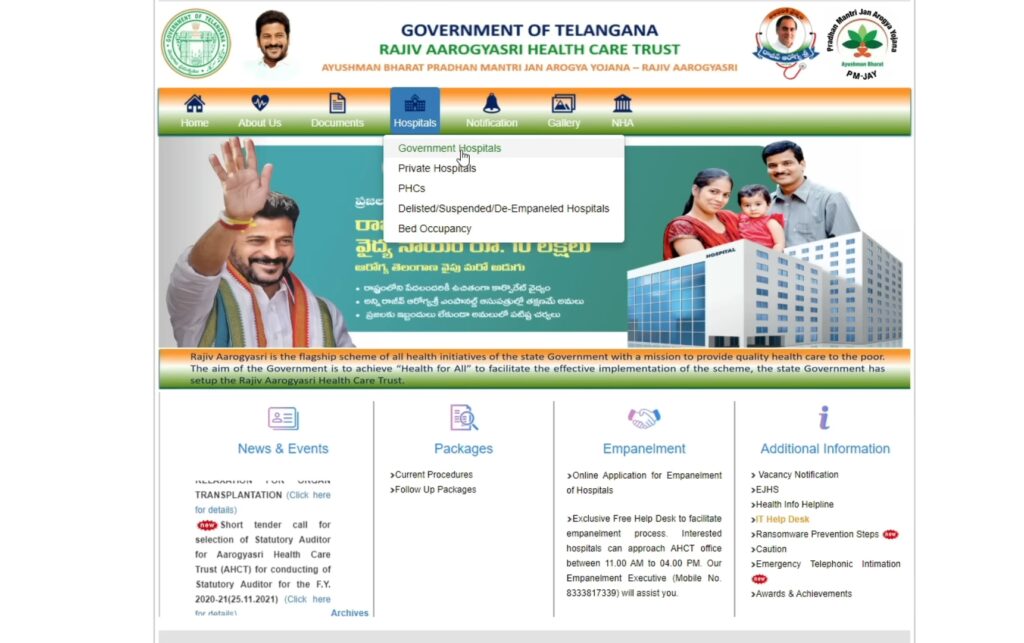

- Visit the Official Website:

- Access the official Aarogyasri website, which serves as the online platform for card applications.

- Create an Account:

- Prospective applicants need to register and create an account on the portal. This account will serve as the focal point for the entire application process.

- Fill Application Form:

- The online application form is comprehensive and requires applicants to provide necessary details. Ensure all fields are accurately filled, and upload the required documents as specified.

- Submit Application:

- Once the application is complete, submit it through the online portal. Applicants are often provided with an application reference number, which can be used for tracking the status of the application.

- Application Tracking:

- Utilize the application reference number to track the status of your application online. This ensures transparency and keeps applicants informed about the progress of their application.

How to Apply for the Telangana Aarogyasri Health Insurance Card Offline:

For those who prefer the offline route, the process is equally accessible. Follow these steps:

- Visit Aarogyasri Center:

- Individuals can visit the nearest Aarogyasri center or a designated government office handling card applications.

- Collect Application Form:

- Collect the Aarogyasri card application form from the center. This form contains all the necessary fields that applicants need to fill.

- Fill the Form:

- Carefully fill in all the required details in the application form. Ensure that the information provided is accurate and supported by relevant documents.

- Submit the Application:

- Once the form is complete and all supporting documents are attached, submit the application at the Aarogyasri center. The staff will guide applicants through the submission process.

Helpline Number & Contact Address

For assistance and inquiries related to Telangana Rajiv Aarogyasri Health Insurance Card, here are the toll-free number and contact details:

- Toll-Free Number: 104 (24/7)

- Contact Address:

Aarogyasri Healthcare Trust

D. 8-2-293 / 82A / ACT,

Road No. 46, Jubilee Hills,

Hyderabad – 500033 - Phone Number: 040-23547107

- Fax Number: 040-23555657

FAQs about Telangana Rajiv Aarogyasri Health Insurance Card:

What is the Telangana Aarogyasri Health Insurance Card?

The Telangana Aarogyasri Card is a government-funded health insurance scheme that provides cashless treatment to eligible beneficiaries in Telangana. The scheme is designed to provide financial protection and access to quality healthcare for all residents of Telangana, regardless of their income or social status.

Who is eligible for the Telangana Aarogyasri Card?

To be eligible for the Telangana Aarogyasri Card, beneficiaries must meet the following criteria:

Domicile: Permanent resident of Telangana for at least 10 years.

Age: 18 years and above.

Annual Income: Below Rs. 5 lakh per annum for rural areas and below Rs. 6 lakh per annum for urban areas.

What are the benefits of the Telangana Aarogyasri Card?

The Telangana Aarogyasri Health Insurance provides a wide range of benefits to eligible beneficiaries, including:

Cashless treatment: Beneficiaries can avail cashless treatment at any empanelled hospital in Telangana.

Wide range of coverage: The scheme covers a wide range of medical procedures and hospitalization expenses, including surgeries, diagnostic tests, and other treatments.

Pre- and post-operative care: The scheme covers pre-operative investigations and post-operative care for up to 15 days.

Family coverage: The scheme covers the applicant and their family members, including spouse, children up to 25 years (unmarried), and dependent parents.

Free ambulance services: The scheme provides free ambulance services to empanelled hospitals for emergency cases.

What diseases are covered under the Telangana Aarogyasri Health Insurance Card?

The Telangana Aarogyasri Health Insurance covers a wide range of diseases, including:

Cancer: All types, including breast, lung, colon, leukemia, and more.

Heart Disease: Coronary artery disease, heart attack, heart failure, and others.

Kidney Disease: Chronic kidney disease, kidney failure, dialysis, etc.

Neurological Conditions: Stroke, Parkinson’s disease, Alzheimer’s disease, cerebral palsy, etc.

Orthopaedic Conditions: Fractures, dislocations, joint replacements, and more.

How to apply for the Telangana Aarogyasri Health Insurance Card?

Beneficiaries can apply for the Telangana Aarogyasri Health Insurance Card online or offline.

Online Application:

To apply online, beneficiaries must visit the official website of the Telangana Arogyasri Health Care Trust and fill out the online application form.

Offline Application:

To apply offline, beneficiaries must visit the nearest Mee Seva center or Tahsildar office and submit the application form along with the required documents.