The Union Cabinet recently made a significant announcement on August 24, 2024, approving the Unified Pension Scheme (UPS) aimed at providing an assured pension post-retirement. This new initiative is a response to the long-standing demands of central government employees for reforms in the New Pension Scheme (NPS). This blog will compare the Unified Pension Scheme and the National Pension Scheme (NPS) in detail, focusing on their features, benefits, and implications for government employees.

What is the Unified Pension Scheme (UPS)?

The Unified Pension Scheme is the latest pension scheme designed specifically for government employees, set to be implemented from April 1, 2025. Unlike the NPS, the UPS promises a fixed, assured pension, providing greater financial security for retirees. The scheme has five main pillars, each addressing different aspects of post-retirement financial support.

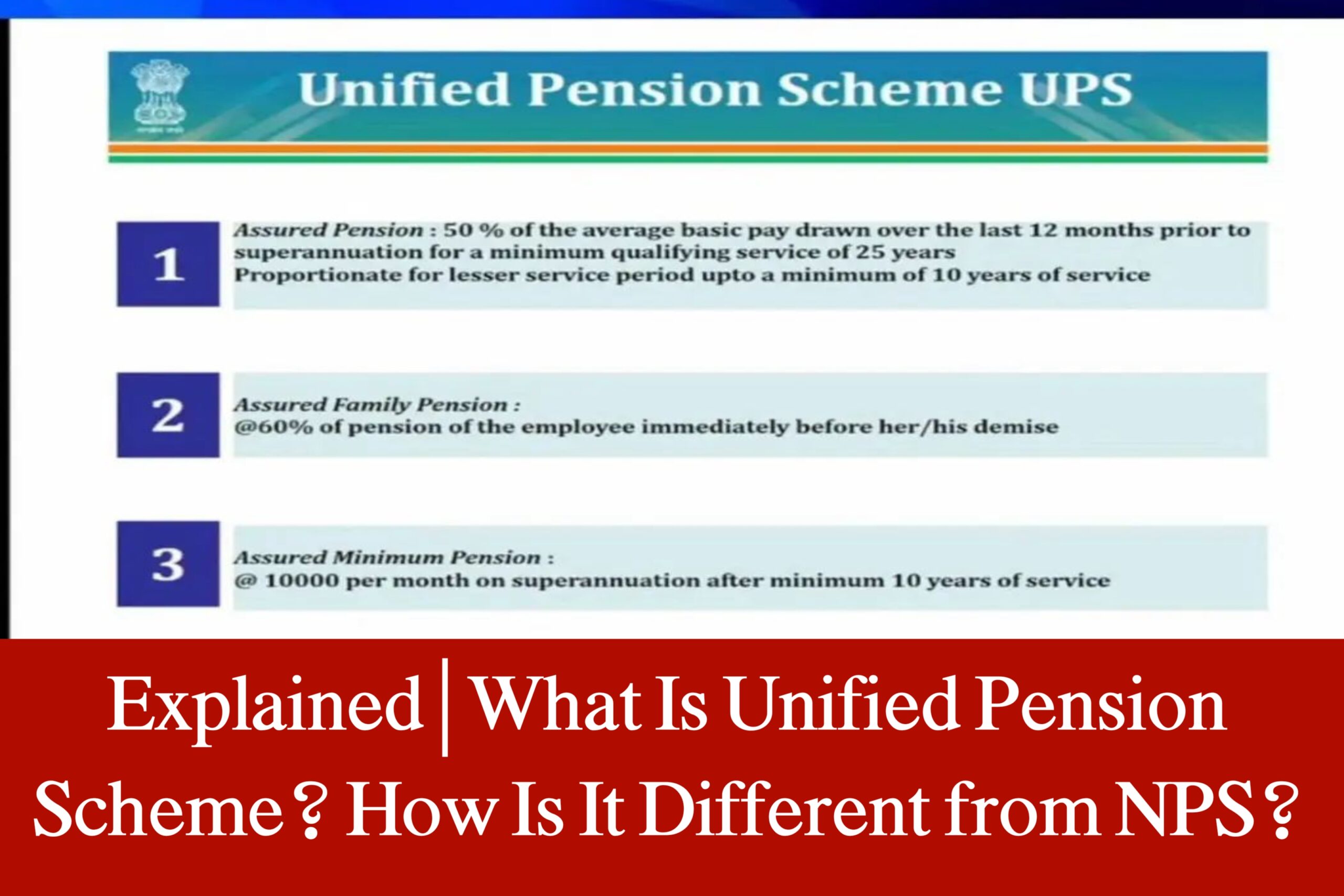

1. Assured Pension

Under the UPS, government employees are guaranteed a fixed pension that is 50% of the average basic pay drawn over the last 12 months before retirement. This is provided the employee has completed a minimum of 25 years of qualifying service. For those with less service (down to a minimum of 10 years), the pension amount is proportionately reduced.

2. Assured Family Pension

In the unfortunate event of the employee’s demise, the family will receive an assured family pension equivalent to 60% of the employee’s basic pay. This support is intended to ensure financial stability for the family during difficult times.

3. Assured Minimum Pension

For employees who retire after at least 10 years of service, the UPS ensures a minimum pension of ₹10,000 per month. This provision is particularly beneficial for those who may not have accumulated a substantial pension fund due to a shorter service period.

4. Inflation Indexation

The UPS includes a provision for inflation indexation, meaning that the assured pension, family pension, and minimum pension amounts will be adjusted to keep pace with inflation. This helps preserve the purchasing power of retirees over time.

5. Gratuity

In addition to the pension benefits, the UPS also provides a lump-sum gratuity payment upon retirement. This amount is calculated as 1/10th of the monthly emolument (basic pay + dearness allowance) for every completed six months of service. Importantly, this gratuity payment does not reduce the pension amount.

Who Can Join the UPS?

Central government employees will have the option to either remain in the NPS or switch to the Unified Pension Scheme. This choice is also extended to those who have already retired under the NPS since its inception in 2004. Even though the UPS will take effect from April 1, 2025, eligible retirees from the NPS will receive arrears for the past, adjusted against their previous withdrawals.

What is the National Pension System (NPS)?

Introduced in January 2004, the National Pension System (NPS) is a government-sponsored retirement plan initially tailored for government employees, but later extended to other sectors in 2009. The NPS operates as a long-term, voluntary investment program for retirement, with the potential for significant returns based on market performance.

NPS Structure and Benefits

- Dual Account Tiers: The NPS offers two types of accounts—Tier 1, which is locked until retirement, and Tier 2, which allows for early withdrawals.

- Tax Benefits: Under Section 80CCD of the Income Tax Act, contributions to the NPS are eligible for tax deductions up to ₹1.5 lakh. Additionally, 60% of the NPS corpus can be withdrawn tax-free at retirement.

- Retirement Benefits: Upon retirement, subscribers can withdraw a portion of their accumulated corpus, with the remaining amount converted into an annuity to provide a regular monthly income.

Differences Between NPS and the Old Pension Scheme (OPS)

The NPS replaced the Old Pension Scheme (OPS), also known as the Defined Benefit Pension System (DBPS). The OPS was based on the last pay drawn by the employee, guaranteeing 50% of the last-drawn salary as a pension after retirement. In contrast, the NPS is a Defined Contribution Pension System (DCPS), where both the employer and employee contribute towards building a pension wealth. This wealth is payable at retirement either as an annuity or as a lump-sum withdrawal.

Under the NPS, 60% of the accumulated corpus can be withdrawn tax-free at retirement, while the remaining 40% is converted into an annuity, currently providing a pension of about 35% of the last-drawn pay. The NPS applies to all central government employees (except the Armed Forces) who joined on or after January 1, 2004, and has been adopted by many state governments as well.

Conclusion

The introduction of the Unified Pension Scheme marks a significant shift in the pension landscape for government employees, offering a more secure and predictable retirement income compared to the NPS. While the NPS has its strengths, particularly in terms of investment potential and tax benefits, the UPS addresses key concerns about assured income in retirement, making it an attractive option for many government employees. As the implementation date approaches, employees will need to carefully weigh their options and consider which scheme best meets their retirement needs.