Google Pay, widely known for its efficient and seamless money transfer services, has introduced a new feature that allows users to apply for personal loans directly through the app. This new facility eliminates the need to visit a bank and submit extensive documentation, making the loan application process more convenient and faster. Although there is no guarantee that every loan application will be approved, the process is straightforward and requires minimal paperwork.

In this article, we’ll walk you through the steps to apply for a personal loan on Google Pay, how to repay it, the loan eligibility criteria, and important rules to follow before applying.

How to Apply for a Personal Loan on Google Pay

Applying for a personal loan through Google Pay is simple. Here’s how you can do it:

1. Open Google Pay and Access the Money Tab

- Start by opening the Google Pay app on your smartphone.

- Navigate to the ‘Money’ tab on the main screen.

2. Select the Loans Option

- Within the Money tab, click on the ‘Loans’ option.

- This will open the Loan Offer section within the app.

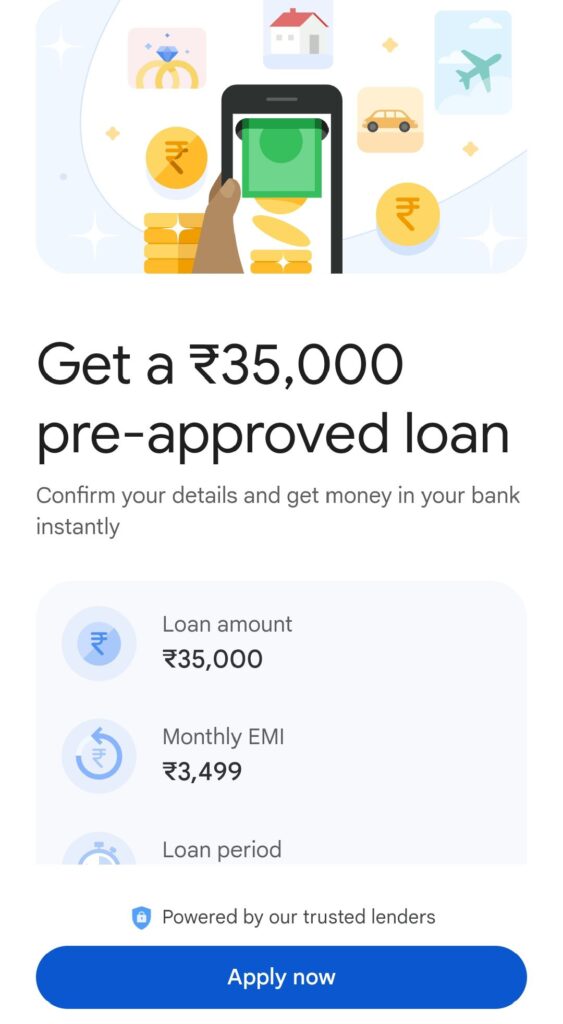

3. Review Pre-Approved Loan Offers

- In the Offer Section, you will see pre-approved loan offers tailored for you.

- Select the offer that best suits your needs.

4. Fill in the Required Information

- Carefully fill in the required details, such as your personal information, PAN card number, Aadhaar card number, and bank account details.

- Make sure to provide accurate information to avoid any delays or issues.

5. Complete the Application with OTP Verification

- After filling out the necessary details, verify your application using the OTP (One-Time Password) sent to your registered mobile number.

- Once verified, the system will process your application, and if approved, the loan amount will be credited to your bank account.

How to Repay the Loan

Repaying the loan through Google Pay is just as straightforward as applying for it. Here’s what you need to know:

1. EMI Auto-Debit from Linked Bank Account

- The loan repayment will be automatically deducted from the bank account linked to your Google Pay.

- The bank will notify you of the EMI (Equated Monthly Installment) amount and the due date.

2. Ensure Sufficient Balance

- Make sure your account has sufficient balance on the EMI due date to avoid any penalties or late fees.

- Failure to maintain sufficient funds can affect your credit score.

3. Credit Score Impact

- Timely repayment of your loan will positively impact your credit score, while delays or defaults can lower it.

How Much Loan Can You Get Through Google Pay?

The loan amount you can receive through Google Pay varies based on several factors, including your income, expenses, and creditworthiness. Here’s an overview:

- Loans typically range from ₹10,000 to several lakhs.

- The amount is determined in collaboration with financial institutions such as Federal Bank, IDFC Bank, and DMI Finance.

Eligibility Criteria for a Loan

To qualify for a loan through Google Pay, you must meet certain criteria. These include:

1. PAN and Aadhaar Card Details

- You must provide your PAN card number and Aadhaar card details.

2. Address Proof

- Accurate address details are required for verification.

3. Bank Account Information

- You need to provide the bank account details where the loan amount will be credited.

4. Eligibility Check

- Google Pay, in conjunction with the associated bank, will verify your eligibility based on the information provided.

Rules to Follow Before Getting a Loan

Before applying for a loan on Google Pay, consider the following guidelines:

1. Understand the Terms and Conditions

- Thoroughly review the terms and conditions of the loan offer.

- Ensure that you understand the interest rates, repayment schedule, and any associated fees.

2. Assess Your Repayment Capacity

- Evaluate your financial situation to determine if you can comfortably repay the loan without affecting your daily needs.

- Consider whether you can manage the payments and interest without undue stress.

3. Be Cautious with Your Information

- Do not hastily provide personal information. Ensure that all details entered are accurate and necessary.

4. Plan Your Finances

- Ensure that taking a loan aligns with your financial goals and is within your ability to repay without jeopardizing your financial stability.

Conclusion

Google Pay’s new loan feature is a convenient way to access funds without the hassle of traditional banking processes. By following the steps outlined above and being mindful of the rules and eligibility criteria, you can easily apply for and repay a loan using Google Pay. However, it is crucial to carefully consider your repayment capacity and understand the terms before proceeding.

Also Check: How to Apply for a Mudra Loan: A Step-by-Step Guide