Bank Account and Minimum Balance:

When we want a bank loan, there’s a process to follow. We should have an account at the bank. It’s important to keep enough money in the account, not going below the minimum balance required.

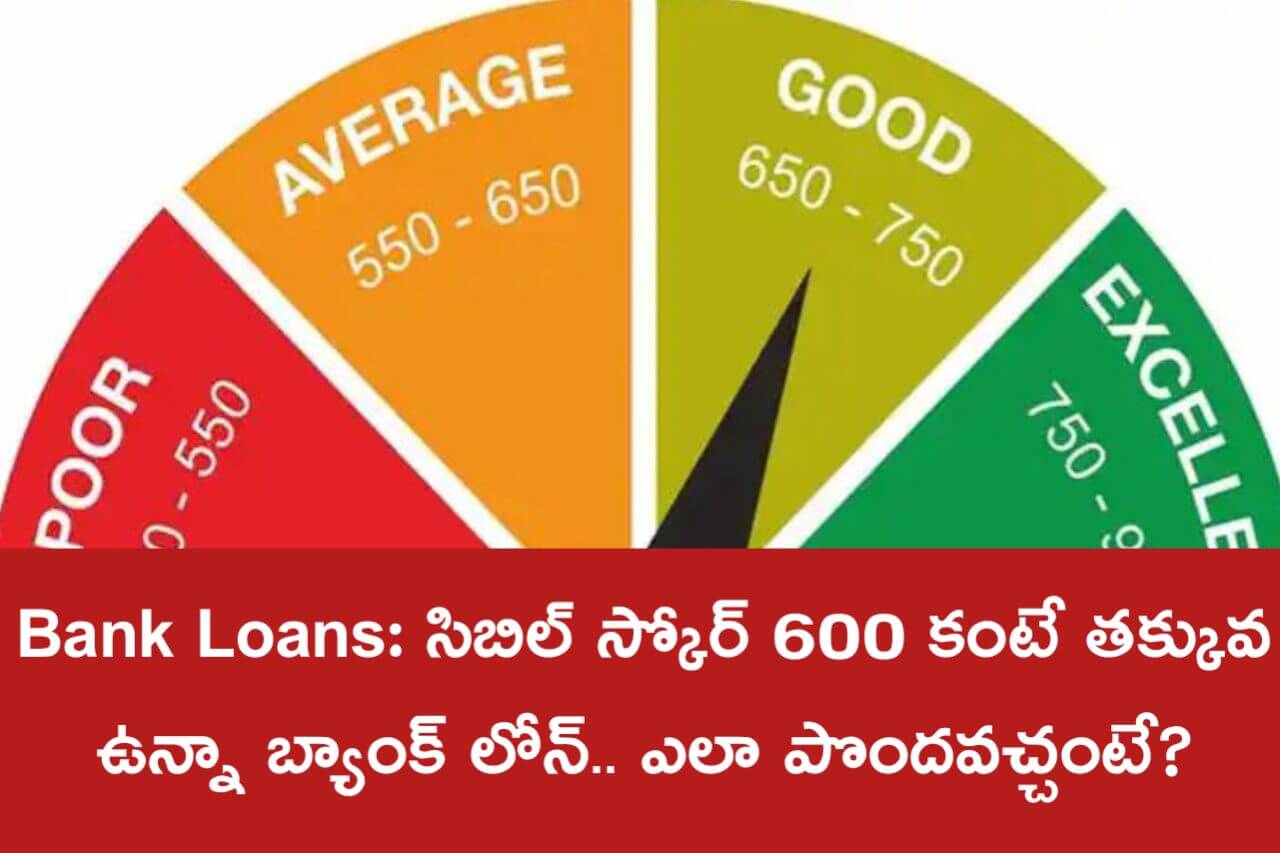

Sibyl Score and Loan Approval:

Our actions with the bank, like maintaining the account and balance, determine something called a Sibyl score. This score decides if the bank can trust us for a loan. The higher our Sibyl score, the better chance we have of getting a loan. But the bank usually only gives loans if our Sibyl score is above 750 points.

Situations when the Sibyl Score Matters:

Sometimes, even if the Sibyl score is between 500 and 600 points, the bank might consider giving a loan. There are special cases when the bank agrees, despite the score being lower.

How Sibyl Score Affects Loans:

The bank uses our Sibyl score to check our credit history. It helps them decide if they should lend us money or not. Having a high Sibyl score is good. If it’s over 750, it’s easier to get a loan, but if it’s under 600, it’s hard. If it’s under 500 or 600, getting a loan is very unlikely.

Other Ways to Get Loans:

It’s not just banks that give loans based on the Sibyl score. Other finance companies and both public and private banks also consider it. If we have policies like LIC, the bank might give a loan using those policies. The bank can also lend money based on our fixed deposits. Even our house can help us get a loan without a Sibyl score.

Secured Loans and Responsibilities:

These methods help us get secured loans. But remember, if we don’t pay our loan installments on time, the bank can take our property and sell it to recover the money we owe.