[sc name=”ka-group-1″][/sc]

The Gruha Lakshmi Yojana in Karnataka is all about helping women become stronger and creating fairness in society. The Congress party in Karnataka started this program.

Its main goal is to give money to women in Karnataka who are in charge of their families.

Women who meet the requirements will get money to help them. They will receive Rs. 2000. This plan is made to give good things to women.

Gruha Lakshmi Yojana Karnataka 2023 Latest news:

The Congress party included a lot of programs for young people in its plans for the Karnataka Legislative Assembly this year. One of them is the Gruha Lakshmi Scheme. Congress talked about this plan in January 2023.

Once the election results are out, there will be a new government in Karnataka. Now, the women in Karnataka who were chosen for the Gruha Lakshmi Yojana can start getting its benefits.

Join WhatsApp Group Gruha Lakshmi Scheme Updates

[sc name=”ka-group-1″][/sc]

Guidelines for gruha Lakshmi scheme

You have two ways to apply: either through Village One or Karnataka One.

People who want to be a part of this program can fill out the application online.

Starting from July 19, those who are going to benefit from this scheme can send in their applications.

After August 16, the money will be put into the bank account of the person chosen to get the money.

They will decide to give the money based on what the applicant said in their application.

If someone doesn’t get the money, it might be because they gave incorrect information when applying.

- LIC Bima Sakhi Scheme 2026 – Eligibility, ₹7,000 Stipend, Benefits & Application Process

The LIC Bima Sakhi Scheme 2026 is a special initiative by the Life Insurance Corporation of India (LIC) to empower women by providing financial support, professional training, and a long-term career opportunity in the insurance sector. This scheme helps women become insurance advisors while earning a fixed stipend and commission income.

What Is the LIC Bima Sakhi Scheme?

The Bima Sakhi Scheme is a women-only stipendiary program that trains participants to work as LIC insurance agents. Selected candidates receive financial support for three years along with structured training and the opportunity to earn commissions through policy sales.

Key Features of LIC Bima Sakhi Scheme 2026

Monthly Stipend Support

Participants receive a fixed monthly stipend for three years:

- Year 1: ₹7,000 per month

- Year 2: ₹6,000 per month

- Year 3: ₹5,000 per month

This stipend helps women earn a stable income while building their career.

Commission-Based Earnings

In addition to the stipend, Bima Sakhis earn commission on every insurance policy sold, allowing income to grow based on performance.

Free Professional Training

LIC provides compulsory training covering:

- Basics of life insurance

- Policy features and benefits

- Communication and sales skills

- Customer handling and financial awareness

Eligibility Criteria for Bima Sakhi Scheme

To apply, the applicant must meet the following conditions:

- Must be an Indian woman

- Age between 18 and 70 years

- Minimum education: 10th pass

- Should NOT be:

- An existing or former LIC agent

- A retired LIC employee

- A close relative of a LIC agent or employee

Step-by-Step Application Process for LIC Bima Sakhi Scheme 2026

Step 1: Check Eligibility

Confirm that you meet all age, education, and eligibility requirements before applying.

Step 2: Visit LIC Office or Official Portal

- Visit the nearest LIC branch office, or

- Apply through the official LIC website when applications are open

Ask for the Bima Sakhi Scheme application form.

Step 3: Fill the Application Form

Enter all required details carefully:

- Name (as per Aadhaar)

- Date of birth

- Education details

- Mobile number and email ID

- Residential address

- Bank account details (for stipend)

Step 4: Submit Required Documents

Attach self-attested copies of:

- Aadhaar card

- Address proof

- 10th class certificate

- Passport-size photographs

- Bank passbook copy

Submit the completed form to LIC.

Step 5: Verification by LIC

LIC will verify:

- Eligibility details

- Educational qualifications

- Submitted documents

Approved candidates move to the training stage.

Step 6: Attend Mandatory Training

Selected candidates must complete LIC training, which is compulsory to continue under the scheme.

Step 7: Appointment as Bima Sakhi

After training completion:

- You receive an LIC agent code

- You are officially appointed as a Bima Sakhi

- Monthly stipend begins

Step 8: Start Policy Sales

As a Bima Sakhi, you will:

- Promote LIC insurance policies

- Educate customers on insurance benefits

- Assist in policy documentation

Work timings are flexible, making it suitable for homemakers and working women.

Step 9: Receive Monthly Stipend

The stipend is credited directly to your bank account as per the scheme year.

Step 10: Earn Commission & Incentives

You earn:

- Commission on policies sold

- Performance-based incentives

This allows income growth beyond the fixed stipend.

Step 11: Continue as a Regular LIC Agent

After completing the scheme period:

- You can continue as a regular LIC agent

- Stipend ends, but commission income continues

- Eligible candidates may apply for higher LIC roles in the future

Benefits of LIC Bima Sakhi Scheme

- Financial independence for women

- Skill development and professional growth

- Flexible working hours

- Long-term income opportunities

- Increased financial awareness in communities

Gruha Lakshmi Yojana Ude Shalu of Karnataka

The Gruha Lakshmi Yojana offers various advantages.

1. Empowering Housewives: This plan aims to make housewives stronger by providing financial help. This enables them to contribute to their family’s income and improve their overall financial situation.

2. Supporting Families: The project provides financial assistance to families, helping them overcome challenges.

3. Promoting Gender Balance: The goal is to achieve gender equality by giving financial support to housewives who handle household responsibilities. This encourages a better balance between genders.

Benefits of Gruha Lakshmi Yojana for Karnataka

The Gruha Lakshmi Yojana aims to give these important benefits to the people it helps:

1. Money Help: This plan gives money to housewives. They can use this money to help their family and improve their money situation.

2. Showing Respect: This plan supports the families of housewives who deserve it. This makes them feel more confident and proud of themselves.

3. Maintenance: The plan gives money to the people who take part. This helps them make their homes better and meet their basic needs. This is good for the health and education of their children.

By doing this, the Gruha Lakshmi Yojana gives money to the people who take part. It also makes their neighborhoods better and makes housewives’ lives better. This plan makes the lives of housewives in Karnataka better.

[sc name=”ka-group-1″][/sc]

Eligibility of Gruha Lakshmi Yojana

Applicant Introduction: This initiative provides financial help to women and families. Let’s understand who can apply.

Head of the Family: Only the leader of the family can join. The person applying must be the family head. This initiative aims to support women managing households, especially those who understand this role well.

Residence: To be eligible, the applicant must live in Karnataka. This is important to benefit the women of Karnataka and use state resources effectively.

Income: The family’s yearly earnings should meet the criteria. This way, the initiative can focus on families with lower income, providing them financial assistance.

Previous Beneficiaries: Those who have already received benefits from State or Central Government programs cannot participate. This ensures that the initiative targets families who need new opportunities and distributes its benefits fairly.

The Gruha Lakshmi Yojana benefits by setting suitable standards for this scheme. It’s important to concentrate on women and state resources. Being adaptable is valuable.

The project prioritizes women, it’s brave, and it’s cost-effective. By fostering self-reliance, it empowers women’s lives and their families, guiding them on a transformative journey.

Documents Required for Gruha Lakshmi

Identity Proof: You can use your Aadhaar Card, Voter ID, Driving License, or any official Government ID.

Address Proof: Show your Ration Card, Electricity Bill, Water Bill, or any Government-approved Address Proof.

Bank Passbook Copy: Provide a copy of your bank passbook to share your beneficiary bank account details.

More Information to Apply for Gruha Lakshmi Yojana Karnataka:

Applying for Gruha Lakshmi Yojana is designed to be straightforward and uncomplicated. The steps for applying will be presented to the government shortly.

Applicants will need to provide personal information like their name, age, address, and income. Supporting documents, such as residence proofs and income certificates, might also be required.

Join WhatsApp Group For Gruha Lakshmi Scheme Updates

[sc name=”ka-group-1″][/sc]

How to Apply for the Gruha Lakshmi scheme online Method 1 :

1. Visit the Seva Sindhu website using the link provided.

2. Log in to your Seva Sindhu account.

3. Click on the “Apply for Services” link, which will lead you to a page showing all available services.

4. Look for the pre-approved Gruha Lakshmi option.

5. Click on the Gruha Lakshmi application, which will open in a new page. Make sure you have all the required information before filling out the form.

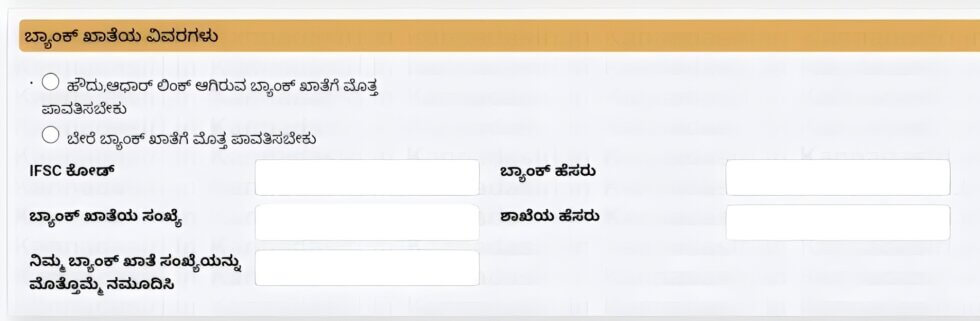

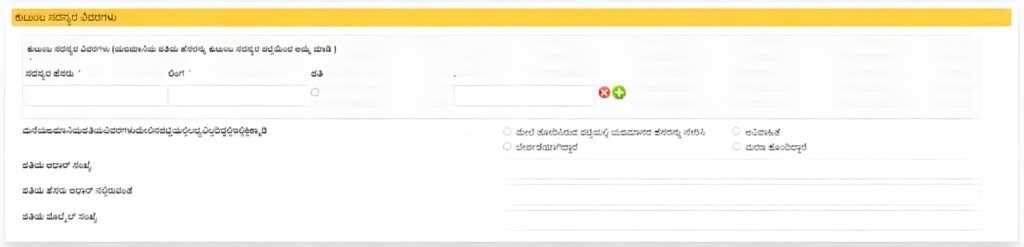

6. In the “Personal Details” section, enter your Ration Card number, your name, and select your category (Scheduled Tribe, OBC Minority, Other). Provide your mobile number.

7. The “Bank Account Details” section will ask you to choose how you want to receive funds. If you choose your Aadhaar-linked bank account, the money will be transferred there. If you choose another bank, provide the IFSC code, bank account number, branch name, and bank.

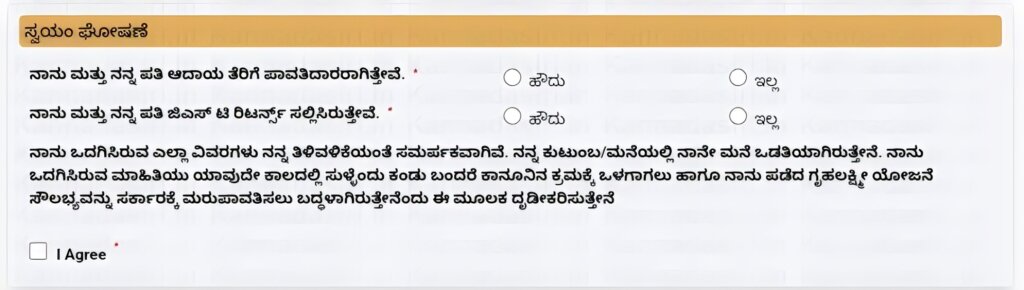

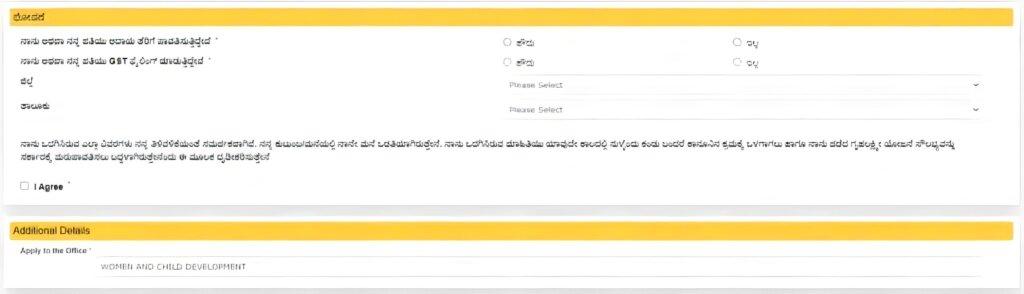

8. In the third part, you’ll find a self-declaration section. Answer “Yes” or “No” to statements like paying income taxes and submitting GST.

9. Confirm that the information provided is accurate and that you’ll take legal action if false information is given. Read and agree.

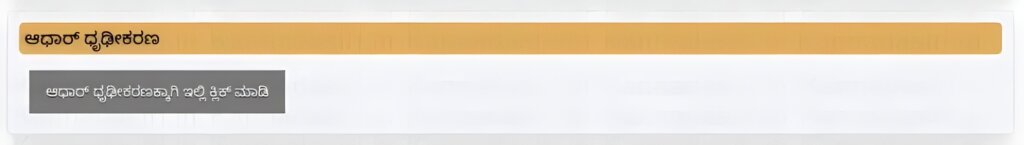

10. For Aadhaar verification, click the “Click here for Aadhaar verification” button. Enter the OTP received on your Aadhaar-linked mobile number.

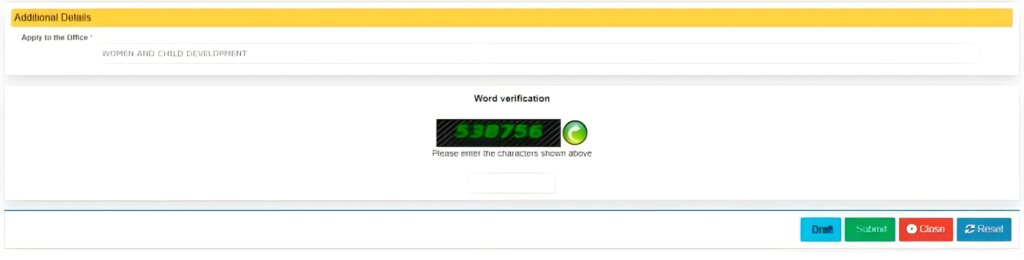

11. Complete the 6-digit word verification, then click the green “Submit” button to review your information. Click “Submit” again to finish. Your application will be sent. Save the receipt as a PDF or take a screenshot for your records.

Applying for the Gruha Lakshmi scheme Method 2 :

1. Go to the official Seva Sindhu website.

2. Log in to your Seva Sindhu account.

3. Click “Apply for Services” and select “View All Available Services.“

4. Choose the Gruhalakshmi scheme.

5. The online application for Gruhalakshmi will open on a new page.

6. Complete the “Aadhar Verification.” Enter your Aadhar number and click the “Click Here” button for Aadhaar Verification. Use the OTP sent to your Aadhar-linked mobile number.

7. Fill out “Householder Details” including Applicant’s Name, Aadhaar number, Mobile Number, Voter’s ID Number, Ration Card type (BPL, AAP, APL), Ration Card Number, category (Scheduled Caste, OBC Minority, Other), bank account number, and upload beneficiary’s photo. Provide Aadhaar-seeded bank name and IFSC.

8. Choose your husband’s name or select one of the options if husband’s details are not available. Enter his Aadhaar number, name, and mobile number if applicable.

9. Answer yes/no questions regarding income taxes and GST. Confirm that the information provided is accurate and you’ll take legal action if false. Read and agree by clicking “I Agree.”

10. Enter the 6-digit code in the text box and click the green button to verify your information. Then click “Submit” to finish. Save the receipt as a PDF or take a screenshot.

Remember, only one woman can apply for this scheme, and she must be the family head. Also, applicants must be residents of Karnataka and not owe any debts to state or central government.

[sc name=”ka-group-1″][/sc]